Go to TradingComputers.com

Optimizing your trade size for maximum long term profits

If you max out your risk on every trade then you will lose your account some day, it is inevitable. The amount you should risk on every trade can be mathematically determined using game theory to give you the highest possible return.

For example: If your winning percentage is 60% and your risk/reward is 1.5:1 then your maximum per trade risk should be 20%. At 20% you will get the maximum return on your money once losses are factored in. If you risk more than that, the losses will set you back too far and you will waste too much money regaining your losses. If you risk less, your return will be less.

The Kelly strategy will make your returns more volatile when compared to a constant dollar approach. It was invented by Dr. J. L. Kelly of Bell Laboratories in 1956: … the maximum rate that earnings may be made over the long term of a series of gambles when the probabilities of winning and losing are well known.

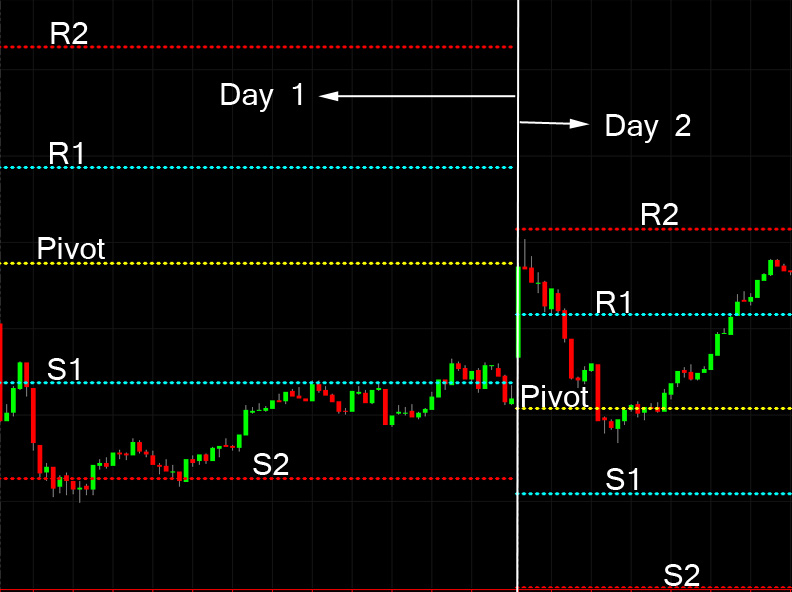

Below the Daily Pivot level are the support levels. The main support levels are S1, S2 and S3 (see the chart above). Likewise there are three major resistance levels above the Daily Pivot known as R1, R2 and R3:

- R3 = R1 + (H - L)

- R2 = P + (H - L)

- R1 = 2 × P – L

- S1 = 2 × P - H

- S2 = P - (H - L)

- S3 = S1 - (H - L)

The pivot levels attract price to them and when price gets there we get a reaction. When the price pauses at a pivot level it will generally pivot away by reversing back where it came from or accelerate as it passes through it. If it passes through it then it will likely go to the next pivot level. If it gets close to a level but is reluctant to touch it then it is very likely to reverse back.

There are some observations that we can make based on these pivot levels: Do not put on a short trade when the price is above R2. Do not put on a long trade when the price is below S2. The first time the market touches S1 is bullish if the price velocity is slowing and it is in the first 30 minutes that the market is open. After 30 minutes you can still trade the first touch for up to an hour after the market open if it touches S1 gently.

If you have an unusually wide range day then the next day will have much wider spacing on the pivot levels, which will render them much less effective. Wide range days are frequently followed by days that are much narrower in range so you may only get an interaction with just one pivot level -and that may not amount to any useful trading opportunities.

Conversely if you have an unusually narrow range day then the next day will have much narrower spacing on the pivot levels. However, narrow days are often followed by more narrow days and the narrow levels that are produced are still tradable, but they are less strong.

You can follow some of my market observations at MarketPirates.net (free of charge).